Investing lets you take the money you’re not spending, as well as place it to benefit you. The money you purchase stocks, as well as bonds, can help federal governments or companies grow while gaining you compound interest. With time, substance interest can take moderate cost savings and transform them into bigger savings, as long as you avoid some investing errors. To get a stock calculator, please click on the link.

You do not always have to study private firms, as well as deal with supplies yourself to become a financier. As a matter of fact, research reveals that this technique is not likely to make you regular returns. The average financier that does not have plenty of time to commit to economic management can probably get away with a couple of low-fee index funds. To learn about the stock investment calculator, please visit the link.

Individuals commonly put cash into financial investments as a method to reach long-lasting goals. These could include reaching a financial turning point like getting a residence, conserving to spend for a kid’s education, or basically away sufficient cash for retirement. To check your stock return calculator, please follow the link.

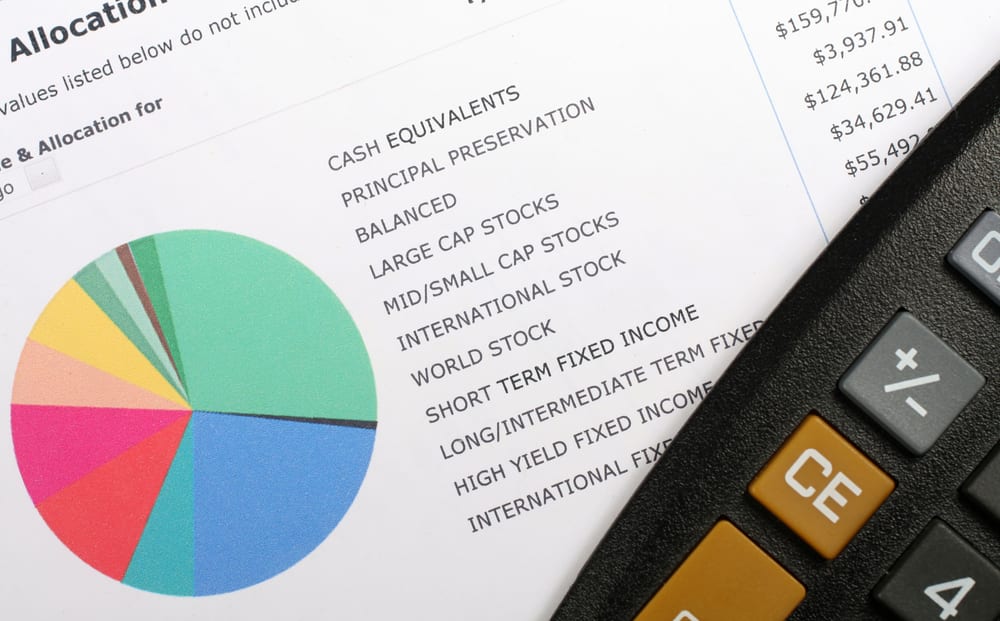

Financial investments are economic products that are purchased with the goal of generating income. Typical financial investments include:

- Stocks: Specific supplies are shares of a business that can raise in value as a firm grows. Investors add them to their portfolios when they are prepared to tackle added threats for potentially higher returns. To find a stock profit calculator, please click on the link.

- Index funds: This possession is a profile of bonds or stocks that tracks a market index. It tends to have reduced fees and costs when compared with proactively handled funds, as well as is based on a long-lasting approach that depends on the marketplace to surpass single investments.

- Exchange-traded funds: These integrate attributes from stocks, as well as index funds into a varied financial investment that similarly tracks the returns of a market index, and can additionally be traded. ETFs usually require smaller-sized financial investments and bring lower charges.

- Mutual funds: This asset pools cash from financiers to get a collection of supplies, bonds, and various other safety and securities that are bundled, as well as traded as one investment. These are normally best for retired life and other lasting investments.

If you are having trouble counting on your investment, then visit the stock calculator return.